Because the tax code is so complex and the responsibility of retirement funding has shifted from employers to individuals the value of a professional planner has never been greater.

Step One

Talk with your spouse about the personal and financial goals that are most important to you.

- Real Estate

- Children & Education Funding

- Business Development

- Retirement / Travel

- Estate Planning / Giving

Step Two

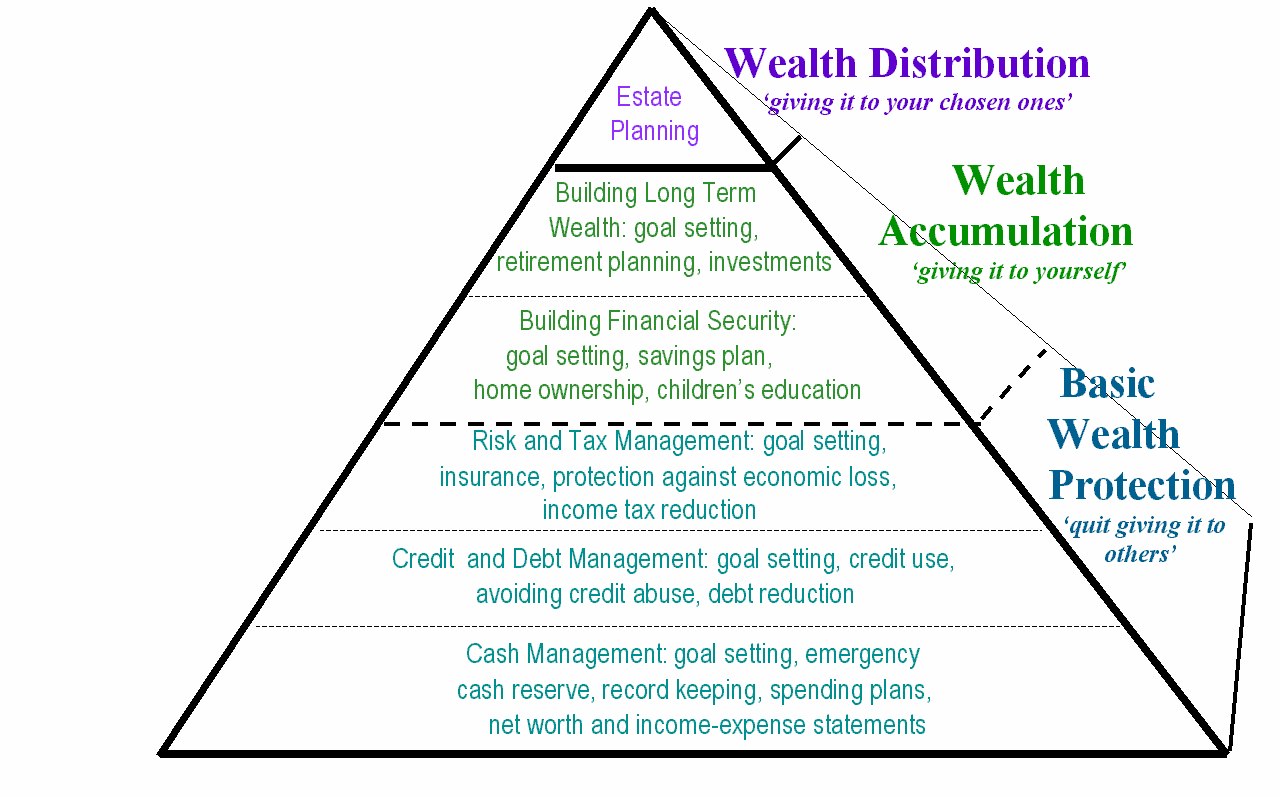

Analyze your savings potential, prioritize and set goals.

- Asset & Liability Balance Sheet

- Annual Income and Expense Check

- Current Plan’s Strengths & Weaknesses

Step Three

Get Professional Advise & Products

- Insurance

Which Companies, What Types, How Much & How Long

– Life, Health, Medicare Supplements, Disability, Long Term Care

- Investments

Goals, Liquidity, Investment Vehicles, Taxes, Portfolio Allocation, Distribution/Income

- Wealth Preservation & Estate Distribution

Wills, Executor, Trust title/type, Assets, Officers, Beneficiaries, Charitable Giving

*Any information on this page is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor or accountant. Anchor Financial Services LLC works in conjunction with legal and tax professionals for estate planning.